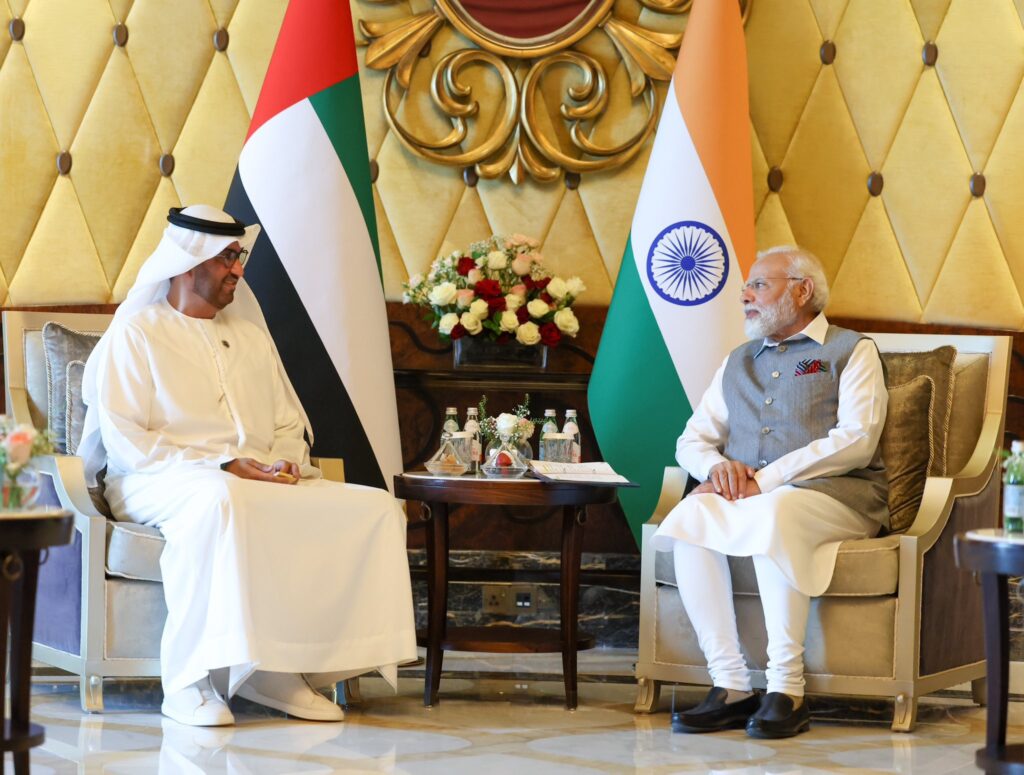

Prime Minister of India Narendra Modi was warmly received by His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the United Arab Emirates and Ruler of Abu Dhabi, at the prestigious Qasr Al Watan Presidential Palace. Various aspects of bilateral relations are going to be discussed extensively between the two leaders.

The United Arab Emirates (UAE) and India recently signed a significant trade agreement that marks a sea change in the way their bilateral trade is conducted. The deal involves the settlement of trade deals between the two countries using the Indian Rupee (INR) instead of the traditional choice of the US Dollar (USD). The unprecedented move reflects the growing mutually beneficial relationship between the UAE and India, and underlines their commitment to promoting domestic trade and enhancing financial cooperation. This piece will shed light on the details of the UAE-India trade deal and put an end to its inherent contradictions.

Background: UAE-India trade relations

The United Arab Emirates and India have a long history of strong mutually beneficial ties. Over time, bilateral trade between the two countries has seen a significant growth, with both countries serving as major trading partners for each other. The UAE is one of the largest importers of Indian goods, including petroleum, clothing and agricultural products, while India is a significant request for Emirati exports such as gold, jewellery and electronics. The trade relationship between the United Arab Emirates and India is primarily based on the use of American bone for settlement.

USD to INR Conversions:

Motivation behind the decision:

The decision to settle trade in Indian Rupee stems from a range of factors. First, both countries aim to reduce their dependence on US BON, thereby diversifying their currency options and reducing their exposure to BON value fluctuations. Second, the use of the Indian rupee is in line with India’s pursuit of promoting the international status of its currency and its role as a major global trading nation. Initially, the move facilitates closer financial cooperation between the UAE and India, paving the way for increased investment and business opportunities.

Benefits of settling trades in INR:

- Mitigation of currency risk By settling the trade in Indian Rupee, both the countries can reduce their currency risk exposure as they will be less affected by the fluctuations in the price of the US bond.

- Cost savings Trading in Indian Rupees can entail cost savings in terms of currency conversion charges and hedging costs.

- The agreement to boost liquidity in INR could increase the liquidity of the Indian currency and boost its use in international deals, which could attract more investments into India.

- Strengthening Profitable Ties The agreement fosters virtually profitable cooperation between the UAE and India, leading to increased investments, common gambling and business hookups.

Possible implications

Promotion of bilateral trade:

The use of INR to settle trade is expected to boost bilateral trade between UAE and India. By simplifying business deals and reducing costs, the move could encourage businesses to explore new opportunities and expand their business volumes. It can also facilitate easy access to Indian requests for Emirati businesses and vice versa.

Cultivating Profitable Relationships:

The UAE-India Trade Agreement represents an important cornerstone in consolidating the beneficial relationship between the two countries. By diversifying their trade deal options, the two countries are increasing their profitable integration and fostering underserved cooperation in areas such as energy, infrastructure, tourism and technology.

Mitigation of currency risk:

The conversion of the Indian rupee to the trade deal reduces the currency risk for both countries. As the Indian rupee is used extensively in international trade, it can provide stability and reduce the impact of fluctuations in the value of the US currency, contributing to a more secure trading area.

Encouraging Regional Trade:

Both the UAE and India are important players in their respective regions – the Middle East and South Asia. The trade agreement has the inherent potential to serve as a catalyst for increased domestic business integration, which will benefit not only both the countries but also other countries in the vicinity. The move may inspire other countries to seek similar arrangements, thereby creating a more connected and prosperous domestic business ecosystem.

The decision by the United Arab Emirates and India to settle trade in the Indian rupee instead of the US currency marks a significant development in their mutually beneficial relationship. The move highlights the emerging dynamics of global trade and reflects the UAE’s faith in Indian thrift. By mitigating currency risks, boosting bilateral trade and enhancing indigenously profitable collaborations, this flagship agreement is set to strengthen UAE-India cooperation and open new avenues for growth and substance.

The UAE-India trade deal represents a step towards a more differentiated and balanced global fiscal geography, as it paves the way for increased use of the Indian rupee in international trade. As soon as the agreement takes effect, both countries can expect to take advantage of reduced currency risk, improved profitable relations and expanded domestic trade opening.